Investing €20,000 in 2026 offers a unique opportunity. With global markets adjusting to a new interest rate cycle, artificial intelligence reshaping industries, and inflation moderating across major economies, investors face both risk and opportunity. The key question is no longer whether to invest—but where to allocate capital for the best balance of growth, security, and flexibility.

Here’s a strategic guide to the best investment options for €20,000 in 2026, depending on your risk tolerance and financial goals.

1. Global Stock Market ETFs: Diversified Long-Term Growth

4

For investors seeking long-term growth, exchange-traded funds (ETFs) remain one of the most efficient ways to invest.

A globally diversified ETF tracking indices such as the S&P 500 or MSCI World provides exposure to hundreds of leading companies across sectors like technology, healthcare, finance, and consumer goods. With €20,000, you can build a diversified portfolio at low cost.

Why consider ETFs in 2026?

- Inflation is moderating, supporting corporate earnings stability.

- Artificial intelligence and digital transformation continue driving productivity gains.

- Long-term equity returns historically outperform most asset classes.

A disciplined strategy—such as investing the full amount or spreading entries over several months—can help reduce timing risk.

2. High-Yield Savings Accounts and Short-Term Bonds: Capital Protection

4

If capital preservation is your priority, fixed-income products are more attractive today than they were a few years ago.

With interest rates still relatively elevated compared to the ultra-low-rate era, high-yield savings accounts, term deposits, and short-term government bonds can provide stable returns with limited volatility.

This strategy may not generate explosive growth, but it offers security and liquidity—ideal for investors who may need access to funds within two to three years.

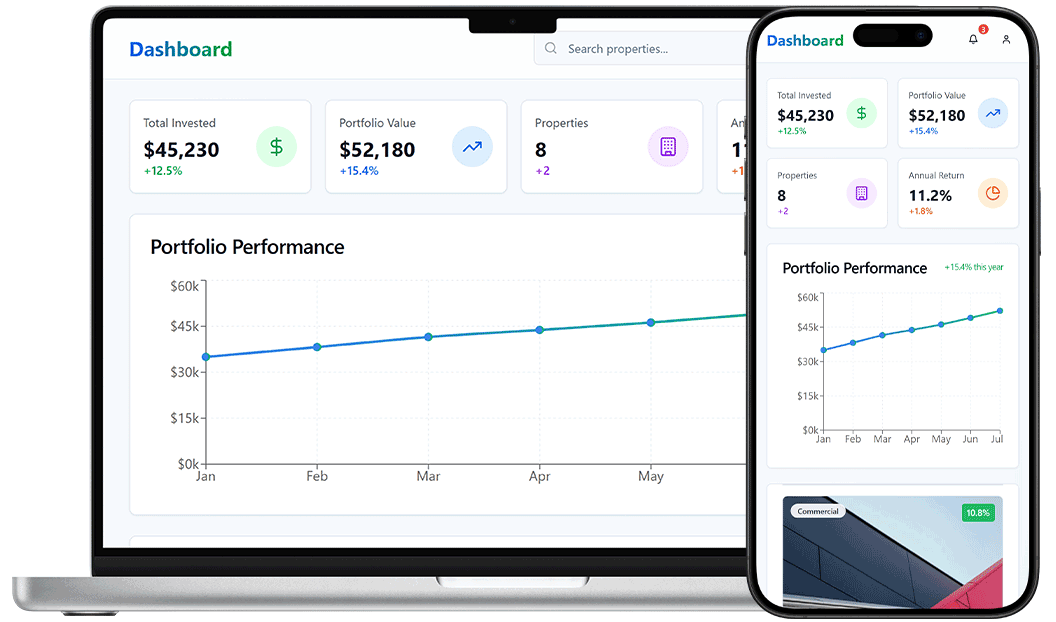

3. Real Estate Investment (Indirect Exposure)

4

Direct property purchases with €20,000 may be challenging in many European markets, but indirect exposure is possible.

Real Estate Investment Trusts (REITs) and property-focused ETFs allow investors to benefit from rental income and long-term property appreciation without buying physical assets.

In 2026, real estate markets are stabilizing after rate-driven corrections. If borrowing costs decline in the coming quarters, property valuations could recover, offering upside potential.

Real estate exposure can also serve as a hedge against inflation over the long term.

4. Artificial Intelligence and Technology Funds

4

Artificial intelligence remains one of the most powerful investment themes of the decade.

Instead of picking individual tech stocks, thematic ETFs focused on AI, robotics, cloud computing, or cybersecurity can offer diversified exposure to high-growth sectors.

Technology stocks can be volatile, but long-term structural trends—including automation, digital infrastructure, and data expansion—continue to reshape the global economy.

Allocating a portion (for example, 20–30%) of your €20,000 to innovative sectors can enhance growth potential while limiting concentration risk.

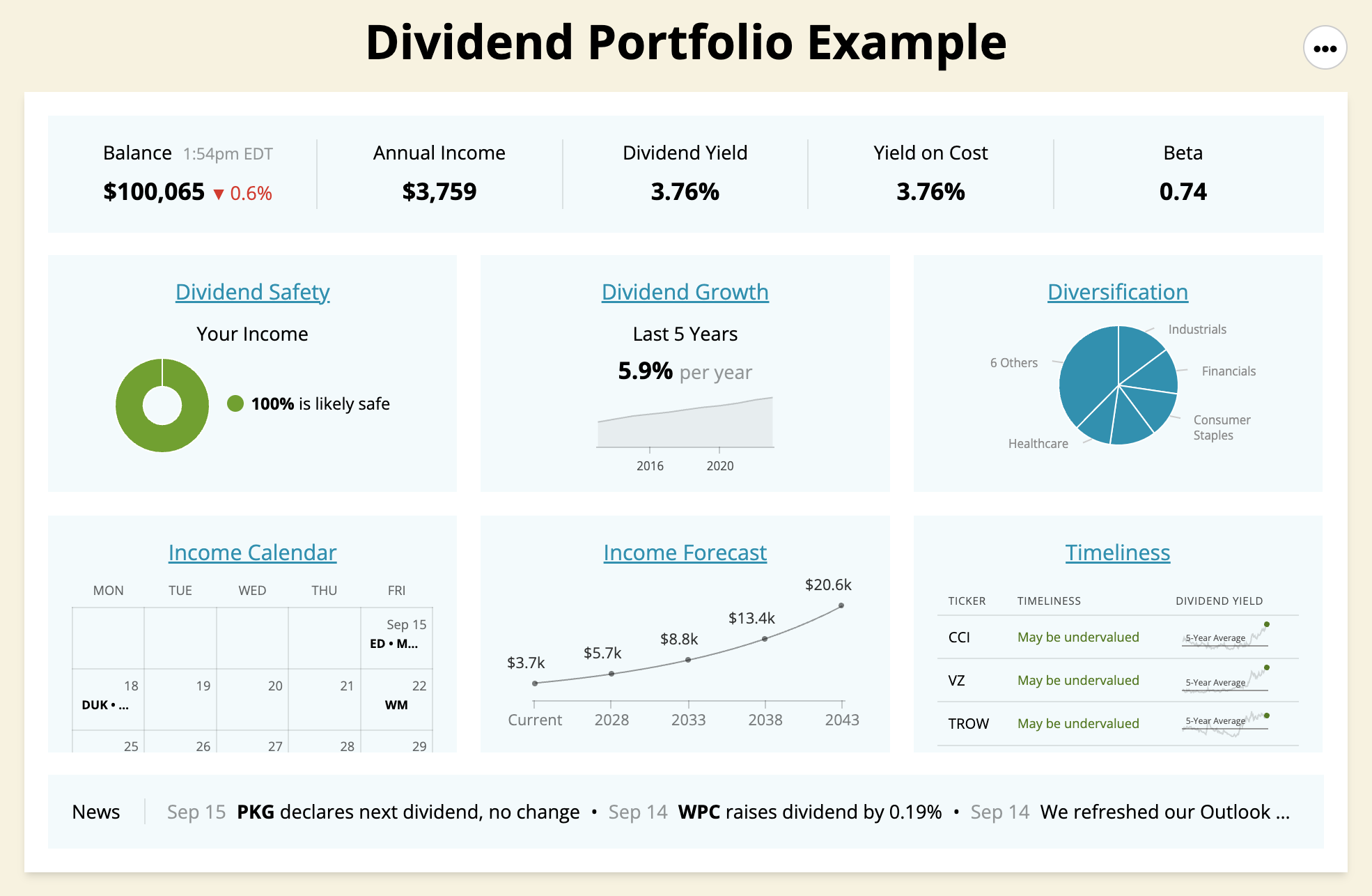

5. Dividend Stocks: Income + Stability

4

Dividend-paying stocks remain attractive for investors seeking both income and moderate growth.

Established companies in sectors such as energy, utilities, consumer staples, and healthcare often distribute consistent dividends. Reinvesting those dividends compounds returns over time.

In a market environment where volatility may increase, dividend strategies can offer relative stability compared to high-growth stocks.

6. A Balanced Portfolio Approach

Rather than choosing just one asset class, many financial advisors recommend diversification.

For example, a balanced €20,000 allocation in 2026 might look like:

- 50% in global equity ETFs

- 20% in AI or thematic growth funds

- 20% in bonds or savings products

- 10% in real estate exposure

This diversified approach spreads risk while capturing growth from multiple sectors.

Key Factors to Consider Before Investing

Before allocating your €20,000, ask yourself:

- What is your time horizon? (Short-term vs. long-term)

- How much volatility can you tolerate?

- Do you need liquidity?

- Are you investing for retirement, income, or capital growth?

Risk management is as important as return potential. Markets can fluctuate in the short term, but disciplined strategies often outperform emotional decision-making.

The 2026 Investment Landscape

The investment environment in 2026 is shaped by three major forces:

- Interest Rate Normalization: Central banks are cautiously adjusting monetary policy.

- Technological Acceleration: AI and automation are boosting productivity.

- Global Economic Resilience: Growth remains steady despite geopolitical uncertainties.

These conditions create opportunities for well-positioned investors who diversify and focus on long-term fundamentals.

Final Thoughts: Making €20,000 Work for You

Investing €20,000 in 2026 can be the foundation of long-term wealth creation. Whether you prioritize growth, income, or capital preservation, the most important step is starting with a clear strategy.

Diversification, discipline, and patience remain the pillars of successful investing. By balancing equities, fixed income, and thematic opportunities, you can position your money to grow steadily in a dynamic global market.

In today’s evolving financial landscape, smart allocation—not speculation—is the key to turning €20,000 into meaningful future wealth.

NextGenInvest is an independent publication covering global markets, artificial intelligence, and emerging investment trends. Our goal is to provide context, analysis, and clarity for readers navigating an increasingly complex financial world.

By Juanma Mora

Financial & Tech Analyst