In 2026, many investors are asking the same question: how can I invest €10,000 with minimal risk while still achieving reasonable returns? After years of inflation shocks, interest rate shifts, and market volatility, capital preservation has become just as important as growth.

While no investment is completely risk-free, there are several low-risk strategies that can help protect your money and generate stable returns. The key is balancing security, liquidity, and yield.

Here are some of the safest and most effective places to invest €10,000 in 2026.

1. High-Yield Savings Accounts and Online Deposits

4

For investors seeking maximum safety and liquidity, high-yield savings accounts remain one of the simplest solutions. Many European digital banks offer competitive interest rates compared to traditional banks.

Why consider this option:

- Capital protection (often covered by deposit guarantee schemes up to €100,000 in the EU)

- Immediate access to funds

- Predictable interest payments

Returns are moderate, but for risk-averse investors, this is one of the safest starting points.

2. Government Bonds and Treasury Bills

4

Government bonds—particularly short-term Treasury bills—are considered low-risk investments when issued by stable economies.

In 2026, yields remain attractive compared to the ultra-low-rate era of the past decade. Short-duration bonds reduce interest rate risk while providing steady income.

Advantages:

- Backed by governments

- Predictable returns

- Lower volatility than stocks

For conservative investors, allocating part of the €10,000 to short-term sovereign debt can provide balance and stability.

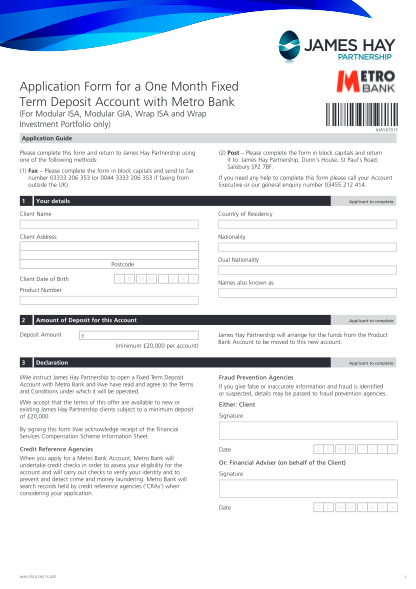

3. Fixed-Term Deposits (Time Deposits)

4

Fixed-term deposits lock your money for a specific period (6–24 months) in exchange for a guaranteed interest rate.

In 2026, competitive rates are available across European banks, especially through online platforms.

Key benefits:

- Guaranteed return

- No market volatility

- Clear maturity timeline

The downside is limited liquidity—early withdrawals may incur penalties.

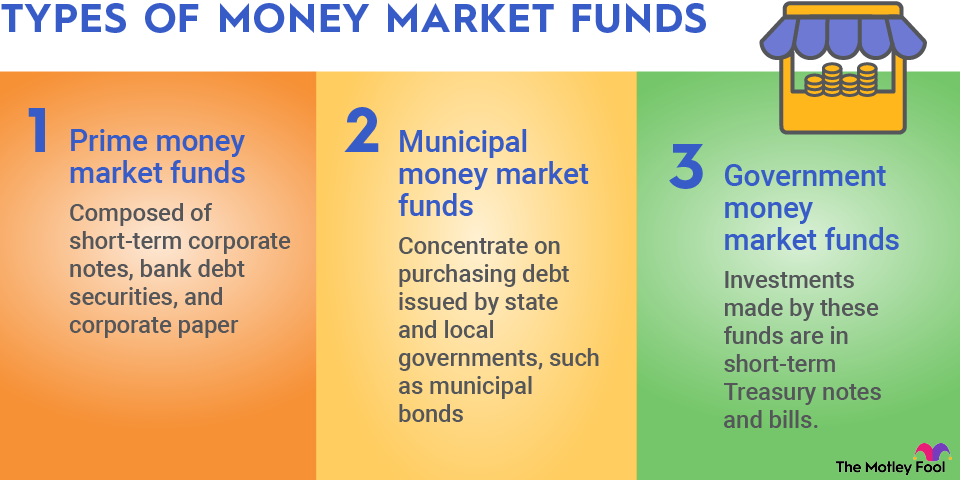

4. Money Market Funds

4

Money market funds invest in short-term, high-quality debt instruments. They aim to preserve capital while offering slightly higher returns than savings accounts.

These funds are generally low volatility and suitable for conservative investors who want modest yield with liquidity.

Why they’re attractive:

- Professional management

- Diversified short-term exposure

- Relatively stable performance

While not insured like bank deposits, they are considered low risk compared to equities.

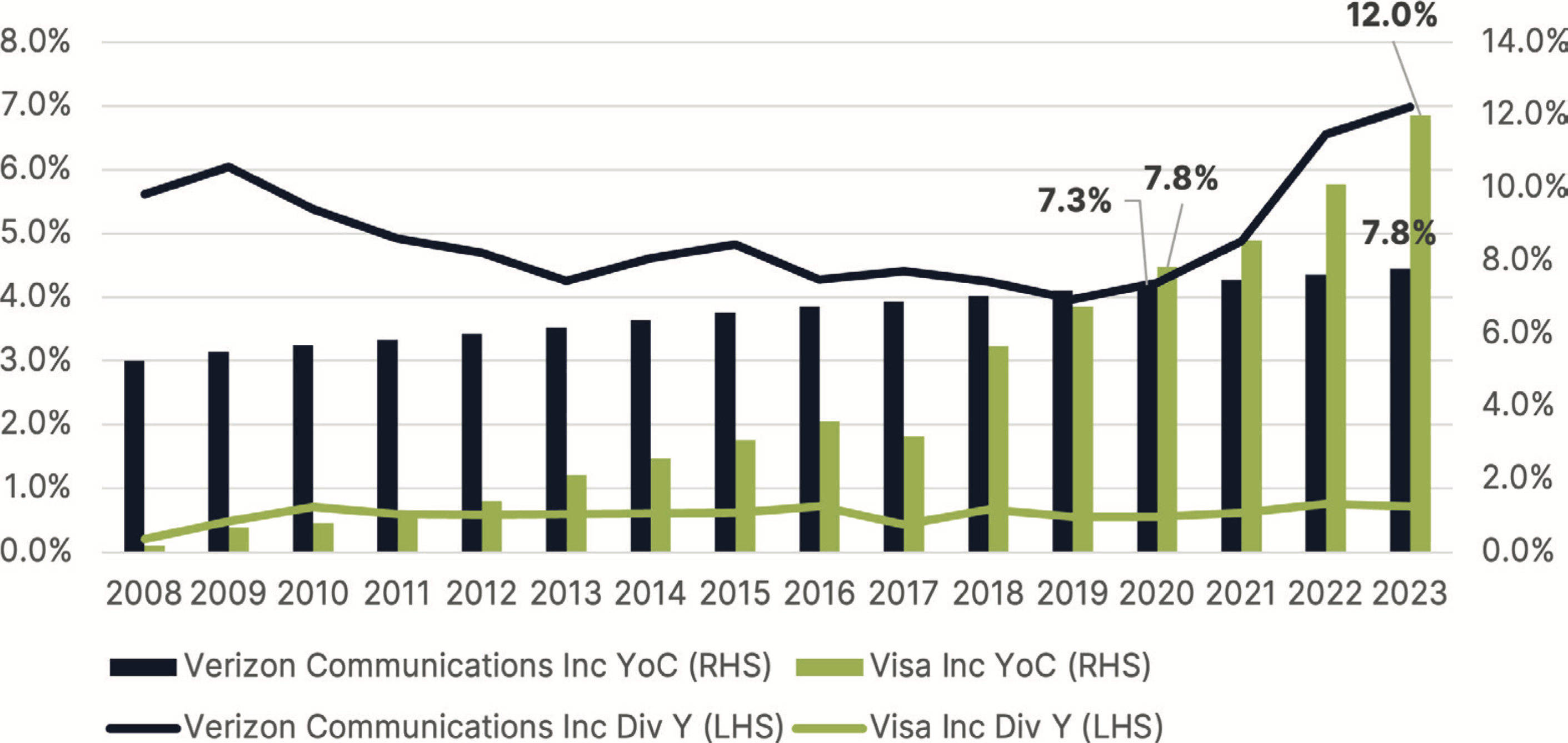

5. Low-Cost Dividend ETFs (Conservative Allocation)

4

For investors willing to accept minimal market fluctuation in exchange for higher potential returns, dividend-focused ETFs can be an option.

These funds invest in established companies with consistent dividend histories. While not risk-free, they are generally less volatile than growth stocks.

A cautious strategy might allocate a small portion (for example, 20–30%) of the €10,000 into a diversified dividend ETF while keeping the rest in fixed-income instruments.

Suggested Allocation Example for €10,000 in 2026

A balanced low-risk strategy could look like:

- €4,000 in government bonds or Treasury bills

- €3,000 in fixed-term deposits

- €2,000 in high-yield savings or money market funds

- €1,000 in a conservative dividend ETF

This structure prioritizes capital preservation while allowing modest growth potential.

Understanding “No Risk” in Investing

It’s important to clarify that “no risk” does not truly exist in financial markets. Even bank deposits face inflation risk—if inflation exceeds interest earned, purchasing power declines.

The real goal is minimizing volatility and protecting capital while achieving returns that outpace inflation over time.

In 2026, interest rates are still relatively supportive compared to the pre-2022 era, meaning conservative investors can finally earn yield without taking excessive risk.

Final Thoughts

If you have €10,000 to invest in 2026 and want low risk with solid returns, focus on safety first, yield second, and diversification always.

Government bonds, fixed deposits, savings accounts, and money market funds form the foundation of a conservative portfolio. A small allocation to dividend ETFs can enhance returns while keeping overall risk contained.

The key to successful investing isn’t chasing the highest return—it’s building steady growth while protecting your capital. In uncertain times, disciplined and diversified strategies often outperform aggressive bets.

For conservative investors in 2026, smart risk management is the real path to long-term financial stability.

NextGenInvest is an independent publication covering global markets, artificial intelligence, and emerging investment trends. Our goal is to provide context, analysis, and clarity for readers navigating an increasingly complex financial world.

By Juanma Mora

Financial & Tech Analyst