Bitcoin is once again under pressure. After weeks of volatility, the world’s largest cryptocurrency has extended its downward trend, triggering fresh debates among investors: Is this a buying opportunity or a warning sign of deeper correction?

As market sentiment shifts and macroeconomic uncertainty continues to weigh on risk assets, both retail and institutional investors are reassessing their strategies. Historically, Bitcoin corrections have often preceded major rebounds—but timing the bottom has never been easy.

Here’s what’s driving the current decline, what analysts are saying, and whether buying the dip makes strategic sense in 2026.

📊 Why Is Bitcoin Falling?

4

Several factors are contributing to Bitcoin’s latest pullback:

1️⃣ Macroeconomic Pressure

Rising bond yields and cautious central bank policies have reduced appetite for high-risk assets. When liquidity tightens, speculative investments like cryptocurrencies often face selling pressure.

2️⃣ Profit-Taking

After previous rallies, some investors are locking in gains. Short-term traders amplify volatility, especially when key technical support levels break.

3️⃣ Regulatory Uncertainty

Ongoing discussions around crypto regulation in major economies continue to create uncertainty. Even rumors of stricter oversight can trigger market reactions.

4️⃣ Market Sentiment

Crypto markets are highly sentiment-driven. Negative headlines or bearish technical signals can accelerate downside momentum.

Despite the decline, Bitcoin remains one of the most resilient digital assets in financial history.

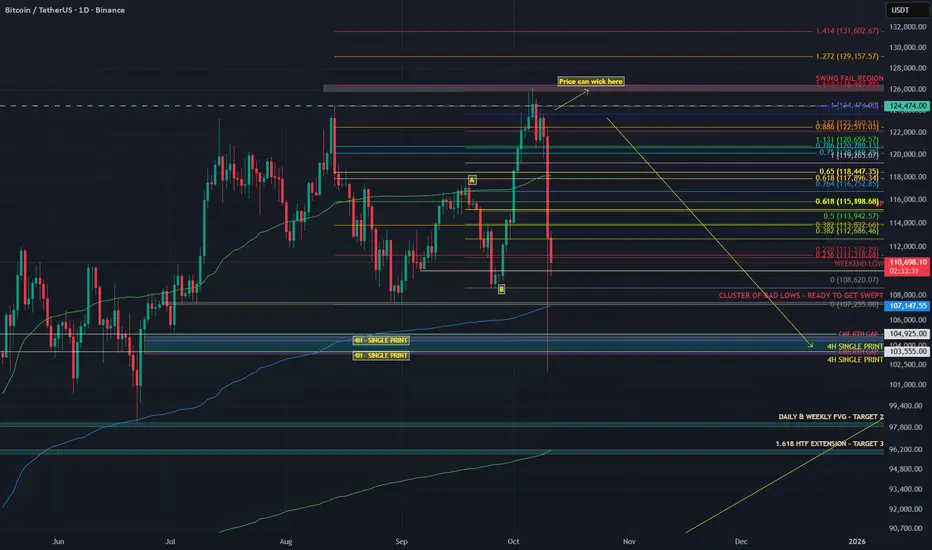

📉 How Deep Could the Correction Go?

4

Technical analysts are closely watching key support zones. Historically, Bitcoin corrections of 20% to 40% within bull cycles have been common.

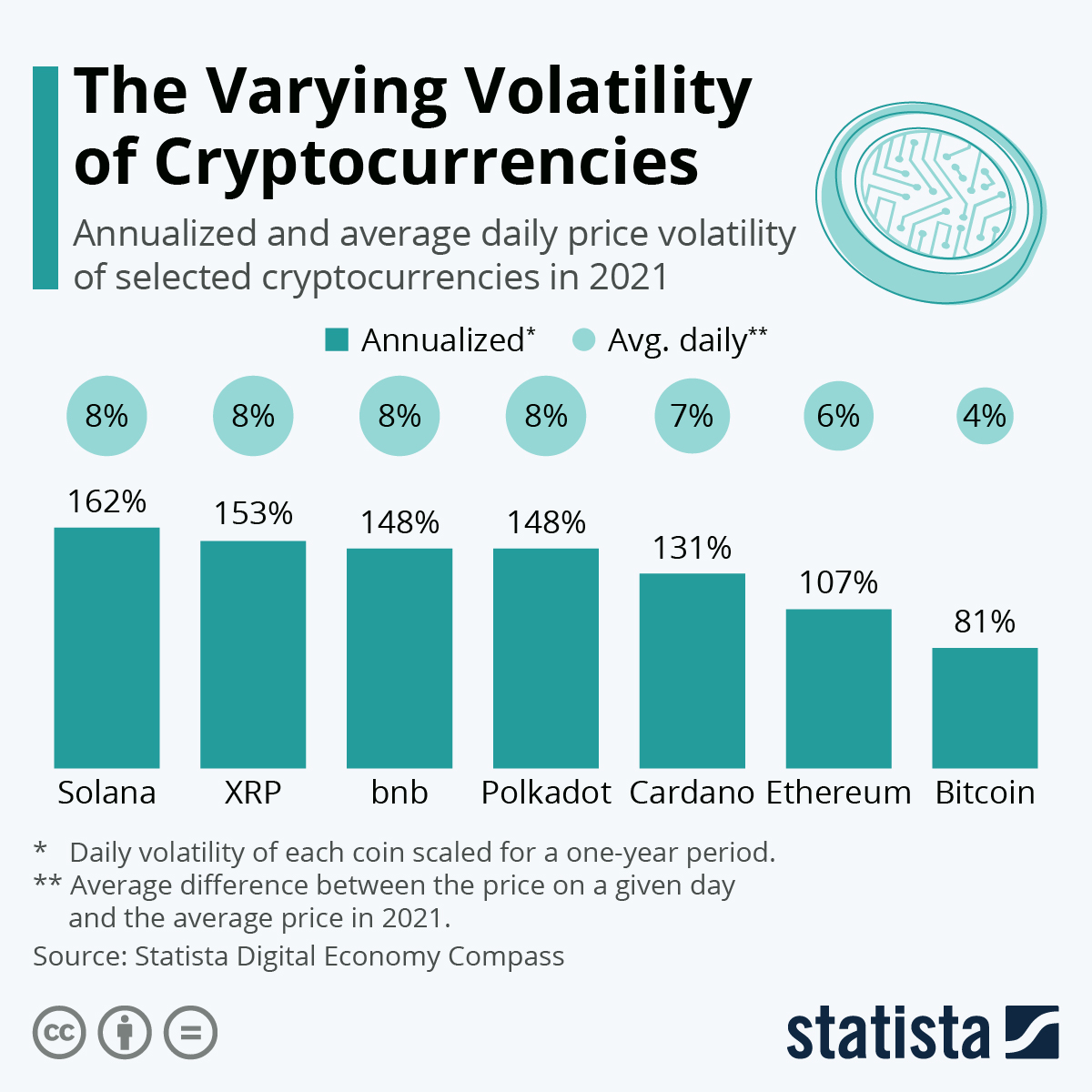

Volatility is not new to Bitcoin. In previous cycles:

- 2017 bull run saw multiple 30% corrections

- 2021 rally experienced sharp pullbacks before reaching new highs

- 2022 bear market led to deeper structural reset

The critical question now is whether this decline is part of a healthy consolidation phase or the beginning of a longer bearish trend.

Long-term investors often argue that short-term corrections are natural within Bitcoin’s broader adoption curve.

💡 Is Buying the Dip a Smart Strategy?

4

“Buy the dip” has become a popular strategy in crypto markets—but it requires discipline and risk management.

Here are key considerations:

✔ Long-Term Perspective

Investors who believe in Bitcoin’s long-term growth thesis often use corrections to accumulate at lower prices.

✔ Dollar-Cost Averaging (DCA)

Rather than trying to time the exact bottom, many investors spread purchases over time to reduce volatility impact.

✔ Risk Allocation

Crypto should represent only a portion of a diversified portfolio. Overexposure can increase financial risk.

✔ Market Cycle Awareness

Understanding whether the market is in expansion, consolidation, or contraction phase is essential.

Buying the dip can be profitable—but only if supported by a strong investment thesis and proper capital management.

📈 The Long-Term Bitcoin Narrative

4

Despite short-term declines, several long-term drivers continue to support Bitcoin:

- Institutional adoption

- Bitcoin ETFs expanding market access

- Growing recognition as digital gold

- Increased global awareness and ownership

- Limited supply (21 million cap)

Many analysts compare Bitcoin’s volatility to early-stage tech stocks—high risk but potentially transformative.

Institutional investors have gradually entered the space, adding structural support compared to earlier cycles dominated solely by retail traders.

⚠ Risks Investors Should Consider

While optimism exists, risks remain:

- Regulatory crackdowns

- Exchange-related instability

- Security breaches

- Liquidity shocks

- Macroeconomic downturns

Cryptocurrency markets can move rapidly in both directions. Investors must evaluate their risk tolerance carefully.

🧠 Expert Opinions: Fear or Opportunity?

Market analysts are divided.

Some believe current weakness reflects temporary macro headwinds and presents an accumulation opportunity before the next growth phase.

Others caution that if global economic conditions deteriorate further, risk assets—including Bitcoin—could face prolonged pressure.

The Fear & Greed Index often becomes a contrarian indicator. Historically, extreme fear has sometimes coincided with strong long-term entry points.

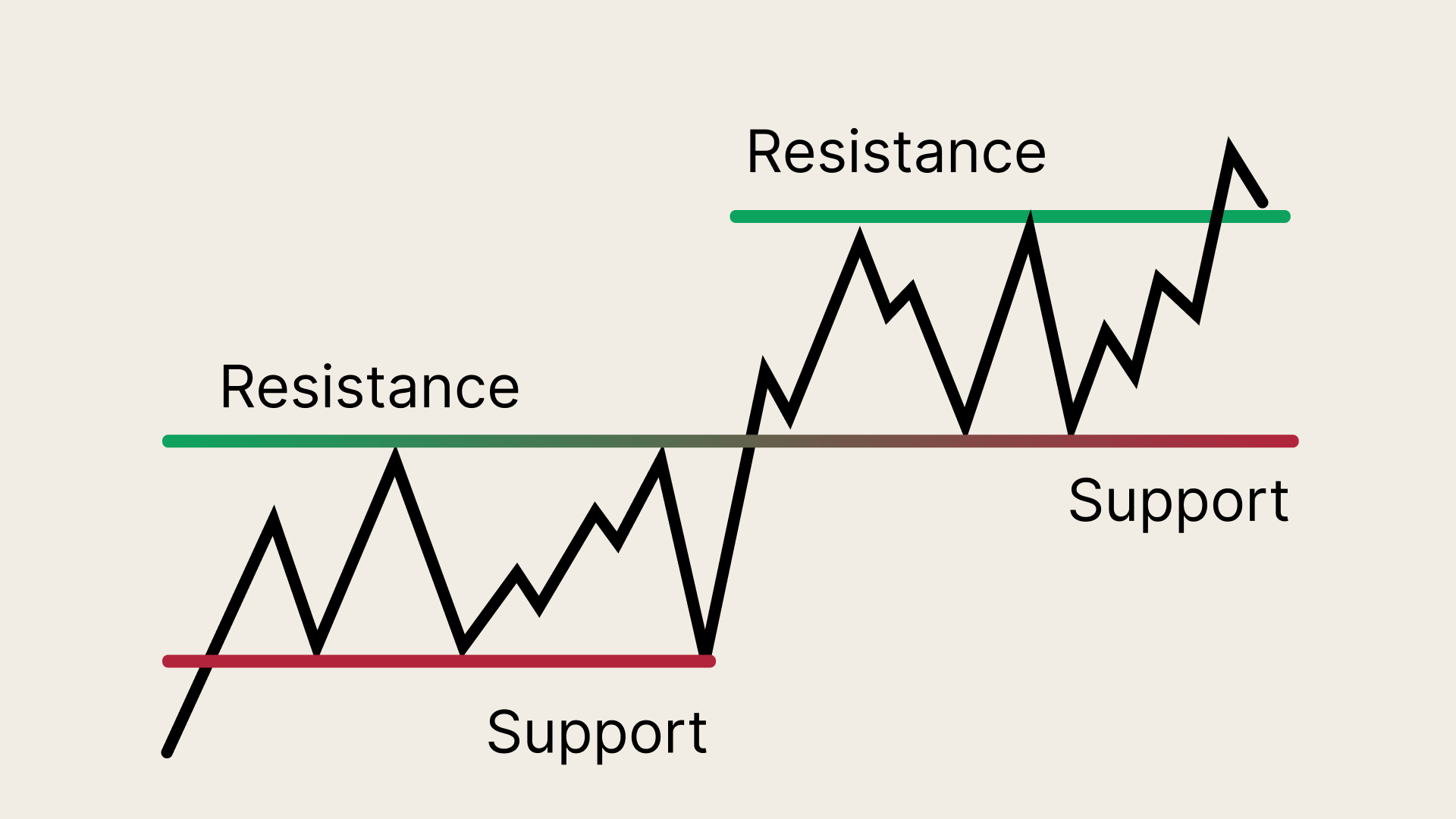

🔍 Key Indicators to Watch

Investors considering buying the dip should monitor:

- Federal Reserve policy decisions

- Bitcoin network activity and hash rate

- ETF inflows and institutional participation

- On-chain data trends

- Technical support and resistance levels

Combining fundamental and technical analysis provides a more balanced perspective.

🏁 Final Verdict: Opportunity with Caution

Bitcoin’s latest drop has reignited the classic investor dilemma: panic or patience?

History shows that Bitcoin has recovered from severe corrections multiple times. However, past performance does not guarantee future results.

For long-term believers in blockchain technology and decentralized finance, gradual accumulation strategies may offer opportunity. For short-term traders, volatility remains both risk and reward.

In 2026, the crypto market continues to mature—but it has not lost its defining characteristic: unpredictability.

Whether this dip becomes a strategic entry point or a deeper correction will depend on macroeconomic forces, regulatory developments, and investor sentiment in the coming months.

One thing remains certain—Bitcoin continues to test the conviction of its investors.

NextGenInvest is an independent publication covering global markets, artificial intelligence, and emerging investment trends. Our goal is to provide context, analysis, and clarity for readers navigating an increasingly complex financial world.

By Juanma Mora

Financial & Tech Analyst