Bitcoin: From a Digital Experiment to a Global Financial Asset

Bitcoin has evolved dramatically since its creation in 2009, transforming from an obscure digital experiment into one of the most influential financial assets in the world. Its price journey tells a powerful story of innovation, volatility, speculation, and growing adoption across the globe.

Bitcoin’s origins trace back to January 3, 2009, when an unknown person or group operating under the pseudonym Satoshi Nakamoto mined the first block of the Bitcoin blockchain, known as the Genesis Block—marking the launch of the world’s first decentralized cryptocurrency. At that time, Bitcoin had essentially no market price and was largely a curiosity for cryptography enthusiasts. iProUP+1

The first real valuation came in 2011, when Bitcoin finally crossed $1 USD for the first time on February 16, 2011, signaling the beginning of public market interest. iProUP

Over the next few years, Bitcoin’s price growth would accelerate beyond what many early observers could have imagined. By April 5, 2013, BTC had risen to $100, and later that year, on November 27, 2013, it surpassed $1,000 USD for the first time—a milestone that amplified mainstream awareness of cryptocurrencies. iProUP

However, that rapid ascent was followed by significant volatility. Bitcoin experienced dramatic ups and downs, reflecting its experimental nature and evolving market dynamics. By late 2014 and throughout 2015, prices fluctuated significantly, but then the market entered a new phase of explosive growth.

The year 2017 marked a historic breakout for Bitcoin. It soared from below $1,000 at the beginning of the year to nearly $20,000 USD by December 17, 2017—a meteoric rise that captured global headlines and drew massive retail and institutional attention. iProUP+1

Following this peak, Bitcoin entered a prolonged correction, often referred to as the crypto winter, with prices dropping substantially over the next year. Yet this downturn did not deter long-term believers, and the market eventually recovered.

The next major bull cycle emerged during the COVID-19 pandemic era. In 2020 and 2021, Bitcoin broke previous records, driven by increased institutional adoption, corporate treasuries allocating BTC, and supportive narratives around digital scarcity. By January 2, 2021, Bitcoin had climbed past $30,000 USD, and just weeks later climbed past $50,000 and $60,000 USD. It continued to rally through the year, peaking above $68,000 USD in late 2021. iProUP

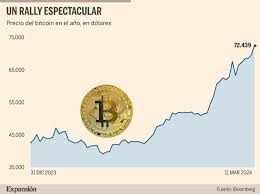

After a period of correction and renewed volatility in 2022 and 2023, Bitcoin’s trajectory turned bullish again. In October and November 2024, Bitcoin achieved multiple all-time highs: surpassing $70,000 USD, $80,000 USD, $90,000 USD, and finally breaking above $100,000 USD on December 4, 2024—a symbolic psychological milestone for the asset. iProUP

The momentum carried into 2025, and by July 14, 2025, Bitcoin reached an all-time peak near $120,000 USD, reflecting immense growth in adoption, investment demand, and narrative strength as a store of value in a world of shifting monetary policies. iProUP

Throughout its history, Bitcoin has not just appreciated in price—it has also demonstrated extreme volatility, undergoing multiple boom-bust cycles that tested the resilience of its supporters and the infrastructure of the broader crypto ecosystem. Investors who held Bitcoin through multiple cycles often refer to HODLing—a term born in 2013 that celebrates holding BTC through volatility rather than trading in and out. Tom’s Hardware

Some of the most iconic stories in Bitcoin lore underscore this transformation. One famous example is the first known commercial Bitcoin transaction: on May 22, 2010, Laszlo Hanyecz purchased two pizzas for 10,000 BTC—a transaction worth about $41 USD at the time. Today, those same 10,000 bitcoins would be valued in the hundreds of millions, even approaching a billion dollars at current price levels, making it one of the most legendary anecdotes in cryptocurrency history. Diario AS

Beyond price milestones, Bitcoin’s evolution represents broader institutional and cultural shifts. From its beginnings as an obscure codebase to its current position as a digital asset held by institutional investors, corporations, and sovereign entities discussing Bitcoin reserves, the journey reflects changing perceptions about money, value, and financial sovereignty.

In summary, Bitcoin’s evolution from a digital experiment with near-zero price to a global financial asset with prices exceeding six figures per coin is a story of innovation, volatility, perseverance, and growing mainstream relevance—one that continues to unfold with each market cycle. Whether viewed as digital gold, a speculative asset, or a hedge against inflation, Bitcoin’s historical journey highlights its profound influence on the future of global finance.