The S&P 500 continues to demonstrate resilience, with several standout companies leading the market’s latest upward move. As investors look beyond short-term volatility and focus on structural growth trends, certain stocks are not only driving current gains but also showing compelling long-term upside potential.

In an environment shaped by artificial intelligence, digital transformation, healthcare innovation, and resilient consumer demand, the leaders of today’s rally could become the core holdings of tomorrow’s portfolios.

Here’s a closer look at the types of S&P 500 stocks currently leading the surge—and why they may still have room to run over the long term.

1. Artificial Intelligence and Cloud Computing Giants

4

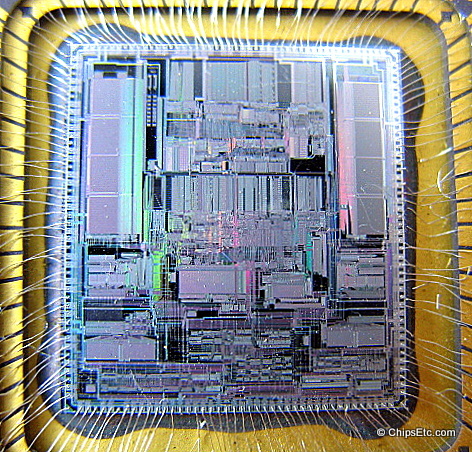

Artificial intelligence remains one of the strongest structural growth drivers in the U.S. equity market. Companies involved in AI infrastructure, semiconductor manufacturing, and cloud computing platforms are at the center of this transformation.

Chipmakers powering AI workloads, hyperscale cloud providers, and enterprise software firms integrating generative AI into their products have seen significant revenue acceleration. Importantly, many of these companies are not just benefiting from hype but from real capital expenditure cycles as corporations invest heavily in digital infrastructure.

Long-term upside potential stems from:

- Multi-year AI adoption across industries

- Expanding cloud penetration globally

- High margins and strong free cash flow generation

- Recurring revenue business models

As businesses continue embedding AI tools into everyday operations, demand for computing power and advanced software solutions is likely to remain robust.

2. Healthcare Innovators and Biotech Leaders

4

Healthcare has quietly emerged as one of the most resilient sectors within the S&P 500. Companies leading advances in biotechnology, medical devices, and pharmaceutical innovation are benefiting from demographic trends and scientific breakthroughs.

An aging global population supports long-term demand for treatments and medical services. Meanwhile, advancements in personalized medicine, immunotherapy, and gene editing are opening entirely new revenue streams.

Many healthcare leaders combine:

- Strong patent portfolios

- Stable cash flows

- Defensive characteristics during market volatility

This mix of growth and stability makes them attractive long-term holdings, especially in diversified portfolios.

3. Consumer Discretionary Champions

4

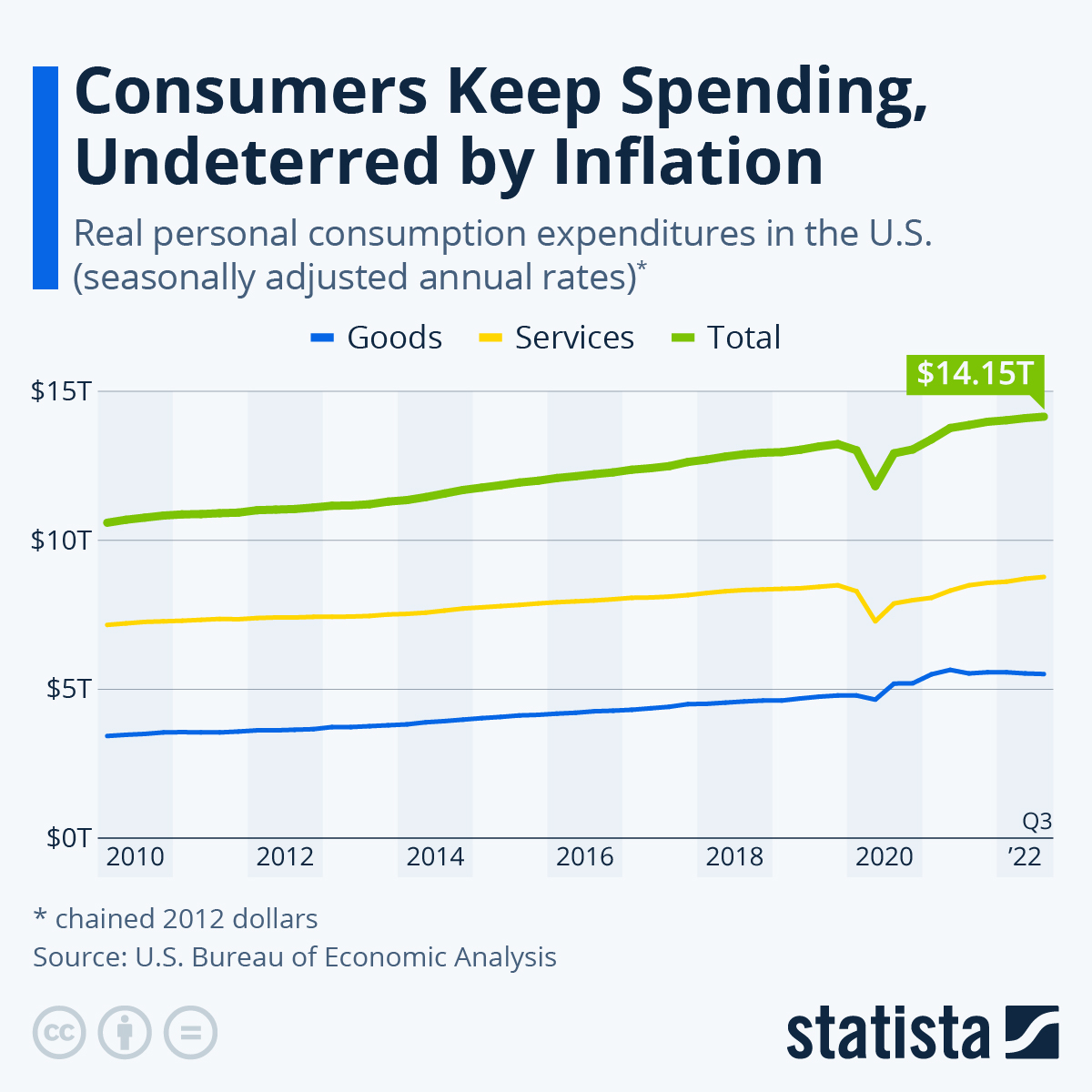

Despite concerns about interest rates and economic cycles, certain consumer-focused companies continue outperforming.

E-commerce giants, premium global brands, and innovative retail platforms are capturing market share thanks to digital ecosystems and strong brand loyalty. High-income consumers remain resilient, and companies with pricing power can protect margins even during slower growth periods.

Long-term investment cases are supported by:

- Expanding global middle-class consumption

- Digital retail transformation

- Subscription-based revenue models

- Strong balance sheets

These firms are not only participating in the current rally but are also positioned for durable expansion.

4. Financial Sector Leaders

4

Financial institutions have regained momentum as interest rate normalization improves net interest margins.

Large, diversified banks and asset management firms are benefiting from stable credit conditions and increased capital markets activity. As economic growth remains steady, loan demand and investment flows can support earnings expansion.

Moreover, digital transformation within banking—such as fintech integration and AI-powered risk management—adds efficiency and cost optimization potential.

For long-term investors, financial leaders offer:

- Attractive dividend yields

- Share buyback programs

- Cyclical recovery potential

While sensitive to macroeconomic shifts, top-tier financial companies remain core components of the S&P 500’s strength.

5. Energy and Industrial Transformation

4

Energy and industrial stocks are also contributing to the S&P 500’s leadership.

Traditional energy companies are benefiting from disciplined capital spending and stable commodity prices, while industrial firms tied to infrastructure upgrades and automation investments are seeing strong order books.

Additionally, the global push toward electrification and renewable energy is creating long-term opportunities for companies involved in grid modernization, battery technology, and clean power generation.

These sectors combine cyclical recovery with structural transformation—an appealing mix for long-term capital appreciation.

Why These Leaders May Continue Climbing

Several macro factors support continued upside potential:

- Earnings Growth: Corporate profits remain resilient despite tighter monetary conditions.

- AI Productivity Gains: Technological adoption is improving margins across industries.

- Strong Balance Sheets: Many S&P 500 leaders hold record cash reserves.

- Global Capital Flows: U.S. equities remain attractive compared to other developed markets.

Although short-term volatility may occur—especially as investors react to inflation data or Federal Reserve decisions—the structural themes driving these companies remain intact.

Risk Considerations

No investment is risk-free. Valuations in some high-growth sectors are above historical averages. Rising bond yields can pressure equity multiples, and geopolitical tensions may introduce market swings.

However, long-term investors typically focus on fundamentals rather than short-term noise. Companies with durable competitive advantages, innovation capacity, and strong management teams are better positioned to weather market cycles.

Final Thoughts: Building Long-Term Wealth With Market Leaders

The S&P 500’s current rally is being powered by companies deeply embedded in transformative global trends—artificial intelligence, healthcare innovation, digital commerce, financial modernization, and energy transition.

While market timing remains difficult, identifying high-quality leaders with sustainable growth drivers can be a powerful long-term strategy.

For investors seeking exposure to U.S. equities, focusing on these leading names—or diversified funds that include them—may provide both participation in current momentum and meaningful upside potential over the coming decade.

In a rapidly evolving global economy, leadership matters. And in the S&P 500, today’s leaders could very well define the market’s future.

NextGenInvest is an independent publication covering global markets, artificial intelligence, and emerging investment trends. Our goal is to provide context, analysis, and clarity for readers navigating an increasingly complex financial world.

By Juanma Mora

Financial & Tech Analyst