The Best Stocks in the U.S. and Europe for Investors This Year

Investing in the stock market requires careful analysis, timing, and strategic selection of companies with strong fundamentals. As 2026 unfolds, both U.S. and European markets offer opportunities for investors seeking growth, dividends, and long-term stability. Despite market volatility, several companies stand out due to solid financial performance, innovation, and market leadership.

Why Now Is a Critical Time for Investors

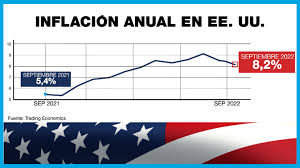

Global markets have experienced fluctuations due to inflation, interest rate adjustments, and geopolitical tensions. However, these challenges also create entry points for long-term investors. Historically, periods of market uncertainty have been ideal for acquiring shares in fundamentally strong companies at attractive valuations.

Analysts suggest that diversifying across sectors and geographies, particularly between the U.S. and Europe, can help mitigate risk while capturing potential upside.

Top U.S. Stocks to Watch

- Apple Inc. (AAPL) – Apple continues to dominate the tech sector with its strong ecosystem of devices, services, and software. With robust sales in iPhones, Macs, and wearables, coupled with expanding revenue from services like iCloud and Apple Music, the company remains a cornerstone for growth-oriented portfolios.

- Microsoft Corporation (MSFT) – A leader in cloud computing, productivity software, and AI integration, Microsoft is benefiting from enterprise digital transformation. Its Azure cloud platform, Office 365 suite, and AI investments position the company for sustained growth.

- Tesla Inc. (TSLA) – As electric vehicles gain global market share, Tesla remains at the forefront of innovation. Expansion in battery technology, energy storage solutions, and international production facilities makes it a compelling choice for investors seeking exposure to the EV revolution.

- Johnson & Johnson (JNJ) – For those seeking stability, J&J offers consistent dividends and resilience in healthcare demand. Its diverse portfolio of pharmaceuticals, medical devices, and consumer health products provides a balanced approach to long-term growth.

Leading European Stocks

- Nestlé S.A. (NESN) – Nestlé is one of the world’s largest food and beverage companies, with a strong presence in emerging markets. Its focus on nutrition, health, and wellness products ensures steady revenue streams, making it a safe bet for conservative investors.

- Siemens AG (SIE) – A global leader in industrial automation, energy, and healthcare solutions, Siemens is well-positioned to benefit from infrastructure modernization and the energy transition. Its diverse operations reduce dependency on any single market segment.

- ASML Holding NV (ASML) – ASML is a critical player in semiconductor manufacturing, providing advanced lithography systems to chipmakers worldwide. With global demand for chips rising, ASML’s technological leadership supports strong growth potential.

- LVMH Moët Hennessy Louis Vuitton SE (MC) – The luxury goods sector continues to thrive, and LVMH remains a top performer in fashion, cosmetics, and beverages. Global demand for high-end products, particularly in Asia, drives long-term profitability.

Key Sectors Driving Market Growth

Technology, healthcare, renewable energy, and luxury consumer goods are among the sectors expected to outperform in 2026. Investors focusing on companies with innovation-driven growth, strong balance sheets, and market leadership are more likely to achieve positive returns.

Additionally, dividend-paying stocks provide a hedge against volatility, offering investors a combination of income and capital appreciation.

Strategies for Successful Investing

- Diversification – Spread investments across multiple sectors and countries to reduce risk.

- Long-Term Perspective – Focus on companies with sustainable competitive advantages rather than short-term market trends.

- Regular Monitoring – Track earnings reports, regulatory changes, and macroeconomic factors that can impact stock performance.

- Balanced Risk – Combine growth-oriented stocks with stable, dividend-paying companies to protect against downturns.

Conclusion

While market uncertainty continues, the current environment offers strategic opportunities in both U.S. and European stocks. Companies like Apple, Microsoft, Tesla, Nestlé, Siemens, and LVMH exemplify strong fundamentals, innovation, and global reach. By investing thoughtfully and diversifying across regions and sectors, investors can position themselves to benefit from long-term market growth.

As 2026 progresses, staying informed, disciplined, and proactive will be essential for capitalizing on stock market opportunities in the U.S. and Europe.

NextGenInvest is an independent publication covering global markets, artificial intelligence, and emerging investment trends. Our goal is to provide context, analysis, and clarity for readers navigating an increasingly complex financial world.

By Juanma Mora

Financial & Tech Analyst