As global markets navigate inflation pressures, geopolitical tensions, and accelerating technological change, investors are increasingly turning to hard assets. Metals—both precious and industrial—are emerging as strategic plays for 2026. From safe-haven gold to growth-driven copper, the new commodities cycle is being shaped by structural forces such as electrification, energy transition, and central bank diversification.

Here are the five best metals to consider buying in 2026—and why they could outperform in the years ahead.

1. Gold: The Ultimate Safe-Haven Asset

4

Gold remains the cornerstone of any metals strategy. In 2026, its appeal is being reinforced by persistent global debt levels, central bank accumulation, and concerns about currency debasement.

Central banks have been net buyers of gold in recent years, signaling a strategic shift toward reserve diversification. Meanwhile, investors view gold as protection against inflation, financial instability, and declining real interest rates.

Why gold stands out in 2026:

- Hedge against inflation and currency weakness

- Strong demand from central banks

- Portfolio stabilizer during market volatility

Gold may not generate income, but it offers stability. For long-term investors, a 5%–10% portfolio allocation to gold remains a prudent diversification strategy.

2. Silver: The Dual Opportunity Metal

4

Silver combines the defensive properties of gold with powerful industrial demand. In 2026, its investment case is strengthened by the rapid expansion of solar energy and electric vehicles.

Solar panels rely heavily on silver for conductivity, and the global push toward renewable energy is driving structural demand. At the same time, silver often outperforms gold during economic expansions due to its industrial component.

Key drivers:

- Renewable energy growth

- EV and electronics demand

- Historically undervalued relative to gold

Silver tends to be more volatile than gold, but that volatility can translate into stronger upside during bull markets.

3. Copper: The Metal of Electrification

4

Often called “Dr. Copper” because of its economic sensitivity, copper is critical to global electrification. Every electric vehicle requires significantly more copper than traditional combustion cars, and renewable energy infrastructure depends heavily on copper wiring.

Supply constraints are emerging as mining investment has lagged demand growth. This imbalance could support higher prices over the medium term.

Why copper is attractive:

- Essential for EVs and clean energy

- Infrastructure modernization

- Limited new supply projects

Copper offers a growth-oriented play tied directly to global industrial expansion and the green transition.

4. Platinum: A Potential Comeback Story

4

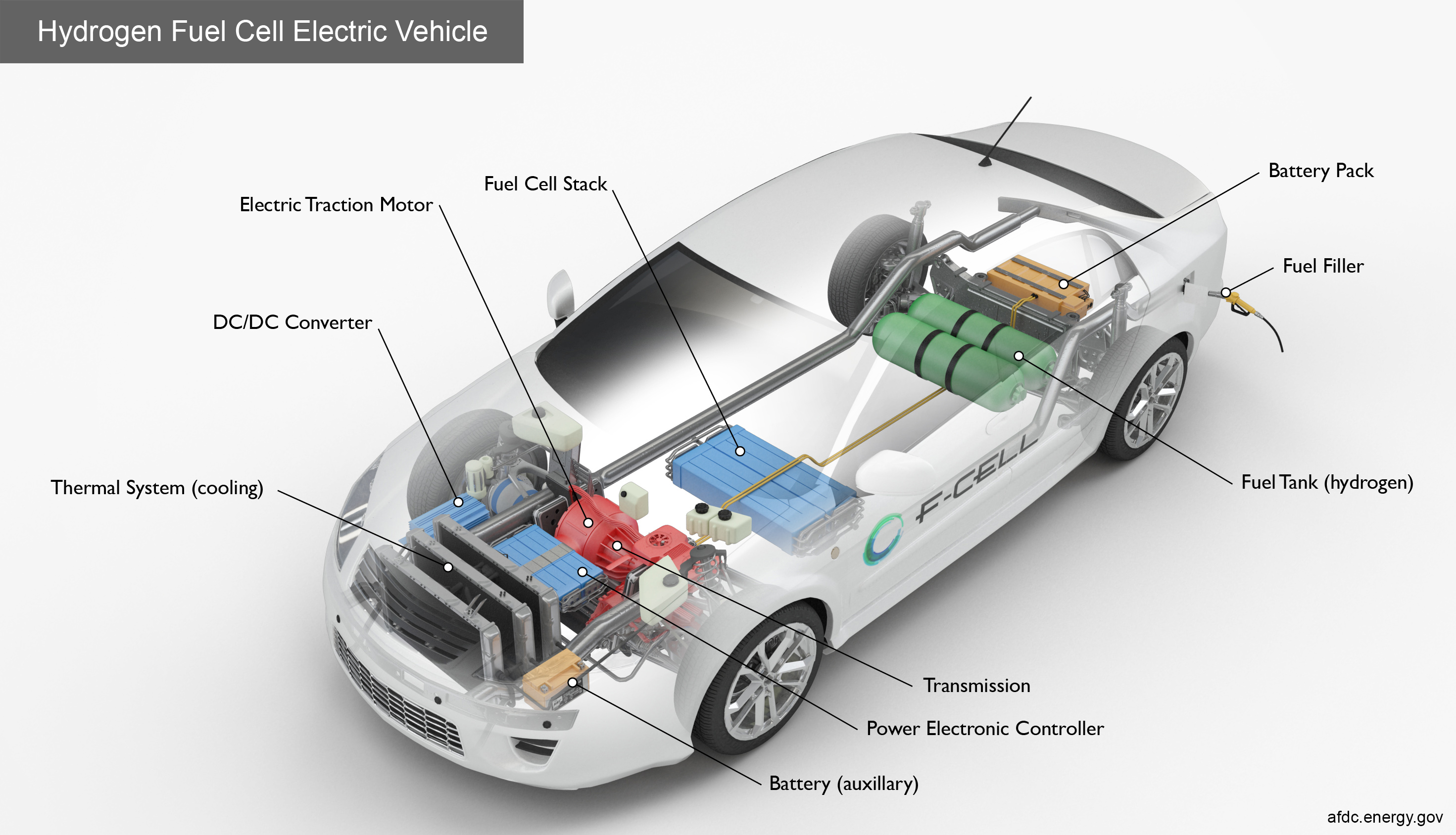

Platinum has traditionally been used in catalytic converters for vehicles, but its investment narrative is evolving. In 2026, platinum is gaining attention due to its role in hydrogen fuel cell technology and potential supply deficits.

Compared to gold, platinum often trades at a discount, which some analysts see as an opportunity. However, it is more cyclical and sensitive to industrial demand shifts.

Investment highlights:

- Growing hydrogen economy potential

- Supply concentration risks

- Relative undervaluation vs. gold

Platinum may appeal to investors seeking diversification beyond traditional precious metals.

5. Lithium: The Battery Revolution Metal

4

Although technically not a precious metal, lithium is one of the most strategic commodities of the decade. As EV adoption accelerates worldwide, lithium demand continues to expand.

Battery production remains heavily reliant on lithium-ion technology. While prices can be volatile due to supply adjustments, long-term structural demand remains robust.

Growth catalysts:

- Electric vehicle expansion

- Grid-scale energy storage

- Technological innovation

Investors typically gain exposure through lithium mining stocks or specialized ETFs rather than physical ownership.

How to Invest in Metals in 2026

Investors have several options:

- Physical bullion (gold, silver, platinum)

- ETFs tracking metal prices

- Mining stocks

- Commodity-focused mutual funds

- Futures (for experienced traders)

Each method carries different risk levels. Physical metals provide direct ownership, while ETFs offer liquidity and convenience. Mining stocks add leverage but also company-specific risk.

Portfolio Strategy for 2026

A balanced approach may include:

- Core allocation to gold for stability

- Tactical exposure to silver and platinum

- Growth allocation to copper and lithium

Metals should complement equities and fixed income—not replace them. Diversification remains essential.

Final Thoughts

The metals landscape in 2026 reflects a world in transition. Gold protects against uncertainty. Silver bridges defense and growth. Copper and lithium power electrification. Platinum offers cyclical upside with emerging technology exposure.

For investors looking to hedge risk while positioning for long-term structural trends, these five metals stand out as strategic opportunities in the evolving global economy.

As markets become more complex and interconnected, tangible assets are reclaiming their role in modern portfolios—making 2026 a pivotal year for metal investors.

NextGenInvest is an independent publication covering global markets, artificial intelligence, and emerging investment trends. Our goal is to provide context, analysis, and clarity for readers navigating an increasingly complex financial world.

By Juanma Mora

Financial & Tech Analyst