U.S. Economy in 2026: AI-Driven Growth Fuels Economic Boom as Inequality Rises

4

The United States is heading into 2026 with strong expectations of economic expansion, largely powered by rapid advances in artificial intelligence (AI). From Silicon Valley to financial hubs in New York and industrial centers across the Midwest, AI is transforming productivity, reshaping labor markets, and attracting unprecedented levels of investment. However, economists and policymakers warn that this technology-driven boom may also deepen income inequality and regional disparities, creating new social and political challenges.

AI as the Main Engine of Growth

Artificial intelligence has become the central driver of U.S. economic momentum. Over the past three years, investment in AI-related infrastructure—such as data centers, cloud computing, advanced semiconductors, and energy capacity—has surged. Major technology companies are allocating tens of billions of dollars annually to expand AI capabilities, while startups focused on machine learning, robotics, and automation continue to attract record venture capital.

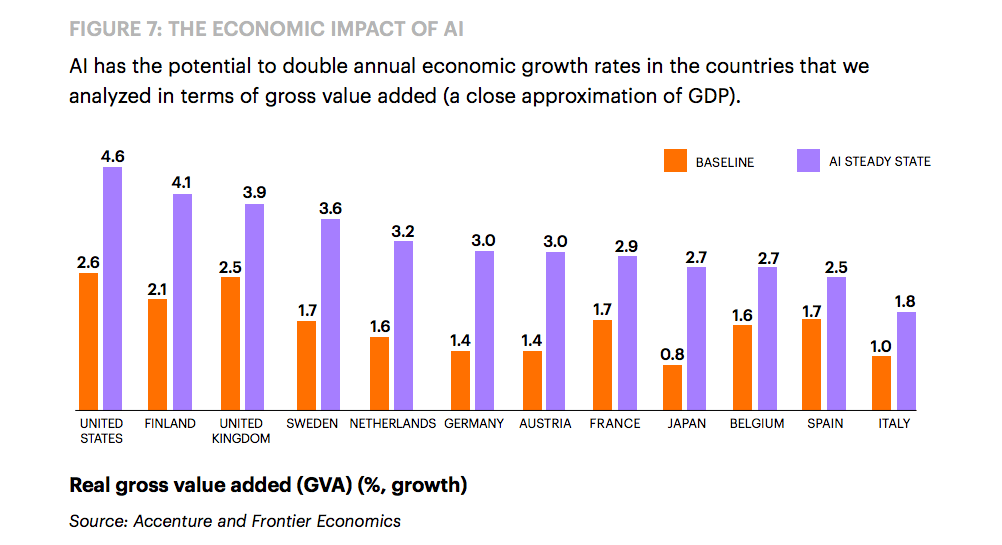

Economists estimate that AI could add between 1 and 1.5 percentage points to U.S. annual GDP growth by 2026, primarily through productivity gains. Automation of routine tasks, improved data analysis, and faster innovation cycles are allowing companies to scale operations more efficiently. Sectors such as finance, healthcare, logistics, defense, and manufacturing are already reporting measurable improvements in output per worker.

This productivity boost is one reason many analysts expect the U.S. economy to outperform other developed economies in 2026, especially Europe, which faces slower growth, higher energy costs, and more rigid labor markets.

Labor Market Transformation

The U.S. labor market remains resilient, but AI is changing its structure. High-skilled workers—such as software engineers, data scientists, AI researchers, and cybersecurity experts—are seeing strong wage growth and rising demand. Salaries in advanced tech roles have continued to climb well above the national average, reinforcing the concentration of wealth in knowledge-intensive sectors.

At the same time, automation is placing pressure on middle- and lower-skilled jobs. Administrative roles, basic customer service, data entry, and some manufacturing positions are increasingly being replaced or augmented by AI systems. While new jobs are being created, they often require specialized skills that many displaced workers do not yet possess.

This dynamic explains why unemployment may remain relatively low in 2026, while wage inequality continues to increase. According to several economic forecasts, the top 10% of earners in the U.S. could capture a disproportionate share of income gains from AI-driven growth.

Rising Inequality and Regional Gaps

Income inequality is expected to be one of the defining economic issues of 2026. The benefits of AI are highly concentrated in specific regions, particularly technology hubs such as California, Texas, Washington, and parts of the Northeast. These areas benefit from strong innovation ecosystems, access to capital, and highly educated workforces.

In contrast, regions more dependent on traditional manufacturing or low-skill services risk falling behind. Rural areas and smaller cities may struggle to attract AI investment, leading to slower wage growth and declining economic opportunities. This regional divide could intensify political polarization and fuel debates over industrial policy and redistribution.

Wealth inequality is also being amplified by financial markets. AI-linked stocks and technology-heavy indices have significantly outperformed broader markets, benefiting investors who already hold substantial assets. Households without exposure to equities or tech-related investments are missing out on much of this wealth creation.

Inflation, Productivity, and Monetary Policy

One of the more optimistic aspects of AI-driven growth is its potential impact on inflation. By increasing efficiency and reducing production costs, AI may help offset inflationary pressures, even as economic activity accelerates. This productivity effect is closely monitored by the Federal Reserve, which is seeking to balance growth with price stability.

If AI-driven efficiency gains continue, the Fed may have more flexibility in its interest rate policy in 2026. Lower inflation could allow for gradual rate cuts, supporting investment and consumption. However, policymakers remain cautious, as rapid technological change can also create asset bubbles, particularly in equity markets linked to AI narratives.

Government Response and Policy Challenges

The U.S. government faces growing pressure to address the unequal distribution of AI benefits. Workforce retraining programs, education reform, and incentives for regional investment are increasingly central to economic policy discussions. Expanding access to STEM education and digital skills is widely seen as critical to ensuring broader participation in the AI economy.

There is also rising debate over taxation, competition policy, and regulation. Some policymakers argue that large technology firms wield excessive power and should contribute more to funding social programs or infrastructure. Others warn that overregulation could slow innovation and weaken U.S. competitiveness against rivals such as China.

National security considerations further complicate the picture. AI is now a strategic asset, with implications for defense, cybersecurity, and geopolitical influence. Maintaining leadership in AI development is viewed as essential to preserving U.S. economic and military dominance.

Outlook for 2026

Looking ahead, most forecasts agree on one central point: AI will be a defining force in the U.S. economy in 2026. Growth is likely to remain solid, supported by innovation, investment, and productivity gains. The United States is well-positioned to lead the global AI race, benefiting from its deep capital markets, entrepreneurial culture, and world-class research institutions.

Yet this success comes with significant risks. Without targeted policies, inequality—both income-based and regional—could widen further, undermining social cohesion and long-term economic stability. The challenge for 2026 will not be generating growth, but managing it in a way that ensures its benefits are shared more broadly.

In this sense, the AI-driven boom represents both an opportunity and a test. How the United States responds may determine not only its economic trajectory, but also the social contract that underpins its prosperity in the decade ahead.