United States Wraps Up 2025 With 2.7% Inflation Amid Cooling Economy

The United States closed out 2025 with an annual inflation rate of 2.7%, marking a significant milestone in the country’s long effort to bring price growth under control after several years of volatility. The figure, which places inflation just above the Federal Reserve’s long-term target of 2%, reflects a cooling economy, easing supply pressures, and the delayed impact of restrictive monetary policy implemented since 2022.

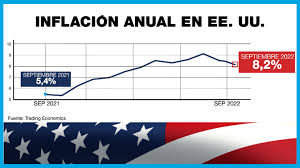

For policymakers, investors, and households alike, the 2.7% reading signals a transition period for the U.S. economy—one that balances slowing momentum with relative price stability. While inflation remains higher than pre-pandemic norms, it is far removed from the multi-decade highs seen in 2022, when price growth exceeded 9% and eroded purchasing power across the country.

A Gradual Return Toward Stability

Inflation’s downward trajectory throughout 2025 was driven by several key factors. Energy prices, a major contributor to inflation swings in recent years, stabilized as global oil markets adjusted to geopolitical risks and improved supply coordination. At the same time, food inflation moderated thanks to better harvests and easing transportation costs, offering relief to consumers who had faced persistent grocery price increases.

Goods inflation continued to cool as supply chains normalized further. The shortages that once plagued automobiles, electronics, and household goods largely disappeared, allowing prices to either stabilize or decline in certain categories. This normalization contrasted with the post-pandemic surge in demand that had overwhelmed production capacity earlier in the decade.

However, services inflation—particularly in housing, healthcare, and insurance—remained sticky. Rent growth slowed compared to previous years but stayed elevated in major metropolitan areas, reflecting long-standing housing supply constraints. Wage growth, while moderating, continued to support consumer spending and contributed to persistent price pressures in labor-intensive sectors.

The Role of the Federal Reserve

The Federal Reserve’s aggressive interest rate hikes from 2022 through 2024 played a central role in bringing inflation closer to target. By maintaining restrictive monetary conditions for an extended period, the Fed aimed to dampen demand without triggering a sharp recession—a so-called “soft landing” that many economists once considered unlikely.

By the end of 2025, borrowing costs remained high by historical standards, weighing on interest-sensitive sectors such as housing, commercial real estate, and business investment. Mortgage rates curtailed homebuying activity, while higher financing costs encouraged companies to delay expansion plans. These dynamics helped cool demand, easing inflationary pressures across the economy.

At the same time, the Fed signaled a cautious approach going forward. With inflation at 2.7% and economic growth slowing, policymakers emphasized the need to avoid overtightening, which could unnecessarily weaken the labor market. Any future rate cuts, officials suggested, would depend on continued progress toward price stability and clear signs that inflation risks are contained.

Economic Growth Shows Signs of Fatigue

The cooling economy mentioned alongside the inflation data reflects broader macroeconomic trends. U.S. growth slowed in the second half of 2025 as consumer spending moderated and business confidence softened. While the labor market remained resilient, job creation decelerated, and the unemployment rate edged higher from historically low levels.

Consumers, facing higher interest rates and the cumulative impact of years of elevated prices, became more cautious. Credit card delinquencies rose modestly, and savings rates increased as households prioritized financial security. Retail sales growth slowed, particularly for discretionary items, highlighting the shift from the robust post-pandemic spending boom to a more restrained environment.

Still, the economy avoided a deep downturn. Strong corporate balance sheets, continued investment in technology and artificial intelligence, and government spending on infrastructure and industrial policy helped support overall activity. The result was a slower, but more balanced, economic expansion.

Implications for Markets and Policy in 2026

For financial markets, inflation at 2.7% reshaped expectations heading into 2026. Bond yields stabilized as investors priced in the likelihood that the Fed is near the end of its tightening cycle. Equity markets responded positively to the prospect of lower inflation and eventual rate cuts, though gains were tempered by concerns about slower earnings growth in a cooling economy.

The inflation data also carried political and fiscal implications. With price pressures easing, pressure mounted on lawmakers to shift focus from inflation control to growth, affordability, and long-term competitiveness. Issues such as housing supply, healthcare costs, and productivity-enhancing investments moved to the forefront of economic debates.

A Delicate Balance Ahead

The close of 2025 with 2.7% inflation underscores the delicate balance facing the U.S. economy. While price stability is within reach, the path forward depends on maintaining progress without undermining growth or employment. External risks—including geopolitical tensions, commodity price shocks, and global economic slowdowns—remain potential wild cards.

Nevertheless, the latest inflation figure represents a clear improvement from the turbulent years that followed the pandemic. For American households, it offers cautious optimism that the era of rapid price increases is fading. For policymakers, it serves as both a validation of past actions and a reminder that sustaining stability requires patience, discipline, and careful calibration as the economy moves into 2026.