Venezuela’s Oil Paradox Keeps Crude Prices Hovering Around the $60-a-Barrel Mark

Despite Venezuela’s vast crude reserves — the largest in the world — global oil prices have remained surprisingly stable near the $60-per-barrel level, baffling market watchers and illustrating a deeper “oil paradox” at the heart of the country’s energy sector and its role in global supply dynamics.

Brent crude futures have largely held around the $60–$63 range, while U.S. West Texas Intermediate (WTI) benchmarks have stayed in the mid-$50s. This range persists even amid significant geopolitical upheaval, including recent political developments in Caracas and ongoing tensions in other oil-producing regions.

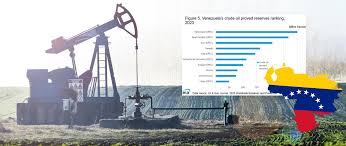

Massive Reserves, Minimal Production

Venezuela’s paradox stems from the fact that its proven oil reserves — estimated at around 303 billion barrels, roughly 17–18 % of the global total — are largely theoretical until they can be efficiently produced.

Despite these immense reserves, actual output has plummeted over the past two decades. Production levels currently hover below 1 million barrels per day (bpd), a far cry from the 3 + million bpd the country once delivered. This decline is primarily due to decades of underinvestment, neglect of infrastructure, and the debilitating impact of international sanctions that restrict Venezuela’s ability to export and finance its oil sector.

Oversupply and Market Realities

Another major factor keeping oil prices around $60 is the global oil oversupply. Even before the recent Venezuelan newsflow, major producers like the U.S., Saudi Arabia, and Russia were contributing to a market where supply outstrips demand by millions of barrels per day. This excess capacity dampens the price effects of political risk or episodic disruptions, as traders believe the market can absorb shocks without sharp price spikes.

In this environment, even substantive political events — such as the U.S. military actions in Venezuela and the detention of President Nicolás Maduro — have had limited influence on oil benchmarks. Analysts note that the market barely reacted with sustained rallies because traders see no immediate structural supply shortage.

Heavy Crude and High Production Costs

Compounding the issue is the nature of Venezuelan oil itself. Most of the nation’s crude lies in the Orinoco Belt, where the extra-heavy oil is expensive to extract and refine. Industry analysts estimate that much of Venezuela’s crude requires oil prices significantly above $60 to be economically viable — in some cases over $80 or $100 per barrel when factoring in diluent needs, upgrading, and transportation costs.

This reality discourages many global oil companies from investing heavily in Venezuelan fields in the near term, especially when lighter, cheaper crude is available elsewhere. Even major U.S. players show caution, highlighting that rebuilding Venezuela’s decayed infrastructure could take years and billions of dollars.

Political Shifts and Investment Prospects

The recent geopolitical shift — including active U.S. interest in Venezuelan oil assets — has introduced new narratives about reopening production and integrating Venezuelan crude into U.S. markets. However, most analysts believe that any meaningful uptick in output will be gradual and long-term rather than immediate.

With the country’s output still negligible relative to global supply, and with structural oversupply persisting across major markets, oil pricing continues to reflect not just Venezuela’s potential, but its practical limitations. Therefore, despite headlines and strategic value, Venezuelan crude remains a symbolic — rather than driving — factor in the current oil price range.