Why Cryptocurrencies May Struggle in 2026 as Short-Term Recovery Catalysts Fade

4

As 2026 approaches, the global cryptocurrency market faces a challenging outlook marked by the absence of strong short-term catalysts to fuel a sustained recovery. After years of extreme volatility, rapid boom-and-bust cycles, and shifting narratives, digital assets such as Bitcoin, Ethereum, and major altcoins are entering a phase of uncertainty. While long-term adoption trends remain intact, analysts increasingly agree that the crypto market may struggle to regain strong upward momentum in the near term.

A Market Lacking Clear Catalysts

Historically, major cryptocurrency rallies have been driven by powerful catalysts: aggressive monetary easing, retail speculation, technological breakthroughs, or regulatory approvals such as Bitcoin ETFs. Heading into 2026, many of these drivers appear either exhausted or already priced in.

Interest rate expectations, once a major tailwind for risk assets, are no longer a decisive factor. While global central banks may gradually ease monetary policy, rates are expected to remain structurally higher than during the ultra-loose conditions that fueled previous crypto bull runs. As a result, speculative capital is less abundant, and investors are more selective, favoring assets with clear cash flows over highly volatile digital tokens.

In addition, the approval and launch of spot crypto exchange-traded products in key markets have already occurred, limiting their ability to spark fresh enthusiasm. What was once a groundbreaking catalyst has become part of the market’s baseline.

Bitcoin and Ethereum: Maturity Brings Slower Growth

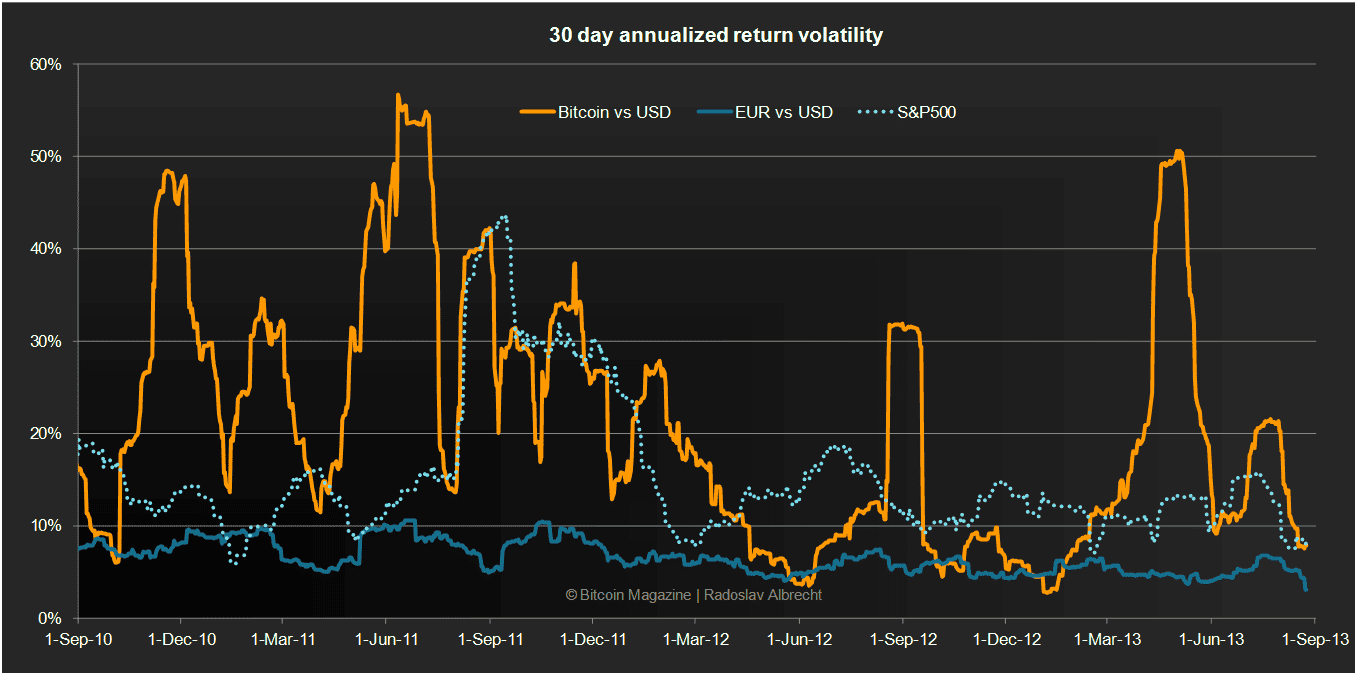

Bitcoin continues to dominate the crypto ecosystem, often viewed as digital gold and a hedge against monetary instability. However, its increasing maturity has reduced its explosive upside potential in the short term. Institutional investors now treat Bitcoin as a portfolio diversifier rather than a speculative bet, resulting in lower volatility but also more limited gains.

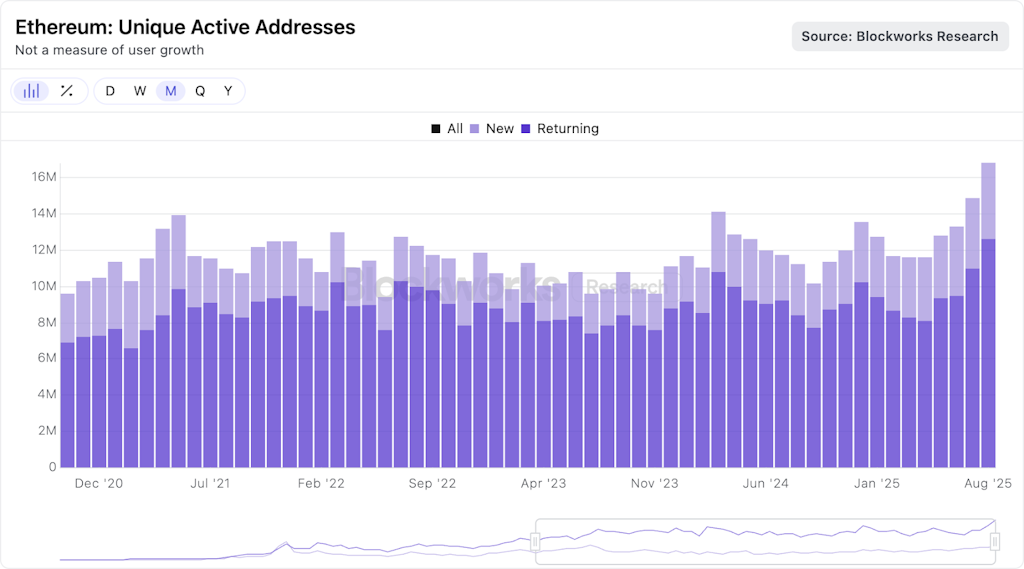

Ethereum faces a different challenge. While its ecosystem remains central to decentralized finance (DeFi), non-fungible tokens (NFTs), and smart contracts, network activity growth has slowed. Competition from alternative layer-1 and layer-2 blockchains has fragmented liquidity and developer attention, weakening Ethereum’s ability to act as a singular market catalyst.

Without a major technological leap or mass-adoption event, both Bitcoin and Ethereum may struggle to lead a broad-based crypto recovery in 2026.

Regulatory Pressure and Uncertainty

Regulation remains one of the most significant headwinds for the cryptocurrency market. Governments and financial regulators across the United States, Europe, and Asia continue to tighten oversight of exchanges, stablecoins, and decentralized platforms. While regulatory clarity is often framed as a long-term positive, the short-term impact is frequently restrictive.

Stricter compliance requirements increase operating costs for crypto companies and limit access for retail investors. In some regions, regulatory uncertainty has delayed product launches, reduced liquidity, and discouraged innovation. For investors, this environment reinforces caution and reduces appetite for speculative positions.

Moreover, enforcement actions and legal disputes involving major crypto firms continue to undermine confidence, reminding markets that the sector remains vulnerable to sudden shocks.

Declining Retail Participation

Retail investors were once the driving force behind explosive crypto rallies, fueled by social media hype and fear of missing out. In 2026, that dynamic appears significantly weaker. Many retail participants suffered heavy losses during previous market downturns and have shifted toward safer investments or exited the market entirely.

Search trends, trading volumes, and on-chain data all suggest reduced retail engagement compared to past cycles. Without renewed retail enthusiasm, crypto markets struggle to generate the momentum needed for a rapid recovery.

At the same time, younger investors increasingly favor artificial intelligence, technology stocks, and tokenized real-world assets over traditional cryptocurrencies, redirecting speculative capital elsewhere.

Competition From Traditional Finance and AI

Another key challenge for cryptocurrencies in 2026 is competition—not from within the crypto space, but from traditional financial markets and AI-driven investments. Equity markets, particularly those linked to artificial intelligence and automation, offer growth narratives backed by revenues, earnings, and tangible productivity gains.

Institutional capital that once flowed into crypto as a high-risk, high-reward alternative is now finding more attractive opportunities in AI infrastructure, defense technology, and energy transition projects. This shift reduces crypto’s relative appeal as a speculative asset class.

Additionally, tokenization initiatives led by traditional financial institutions are blurring the line between crypto and conventional finance, potentially capturing value without relying on volatile public tokens.

Long-Term Potential vs. Short-Term Reality

Despite these challenges, the long-term case for cryptocurrencies has not disappeared. Blockchain technology continues to evolve, and use cases such as cross-border payments, decentralized identity, and tokenized assets remain promising. However, these developments tend to progress slowly and do not necessarily translate into immediate price appreciation.

For 2026, the disconnect between long-term innovation and short-term market performance is likely to persist. Without a strong macroeconomic shock, major policy shift, or breakthrough adoption event, cryptocurrencies may remain range-bound, experiencing periodic rallies but lacking sustained upward momentum.

Outlook for Crypto Investors in 2026

The outlook for cryptocurrencies in 2026 suggests a period of consolidation rather than recovery. Price action may be driven more by technical factors and selective narratives than by broad market optimism. Volatility will remain, but expectations of a rapid, across-the-board bull market appear increasingly unrealistic.

For investors, this environment favors caution, diversification, and a focus on fundamentals. Projects with clear utility, strong governance, and sustainable economic models are better positioned to survive, while speculative tokens without real adoption risk fading into irrelevance.

In conclusion, cryptocurrencies may struggle in 2026 not because the technology has failed, but because the market lacks the powerful short-term catalysts that once fueled dramatic recoveries. Until new drivers emerge, patience rather than speculation is likely to define the crypto investment landscape.